- Home

- Cryptocurrency bitcoin price

- Eth max price

- When could you first buy bitcoin

- Cryptocurrency company

- Buy ethereum with credit card

- Centralized crypto exchanges trading volume year

- Cryptocurrency exchanges

- Bitcoin's value today

- Multichain ethereum binance smart chain avalanche

- Send bitcoin

- Crypto to usd

- Btcto usd

- Buy crypto with credit card

- Sos crypto

- Bitcoin price usd prediction

- 3 reasons to buy dogecoin

- Where to buy ethereum max

- Etc crypto

- Crypto dogecoin

- What the hell is bitcoin

- Current eth gas price

- Cryptocom trading fees

- Bitcoin trend

- Buy elon crypto

- 1bitcoin to dollar

- Dogecoin volume

- Where to buy crypto

- Apps cryptocurrency

- Elongate crypto

- Dogecoin converter

- Dent crypto

- How many btc are there

- Where to buy bitcoin

- Ethusd converter

- Price of bitcoins in usd

- Best broker to buy dogecoin

- Safemoon crypto price

- Bitcoin cryptocurrency

- Cryptocurrency to buy

- Cryptocoin com coin

- Cryptos

- How much is 1 bitcoin worth in cash

- Inu passes no cryptocurrency

- To invest all profits in crypto

- Where to buy shiba inu crypto

- Bitcoin euro

- Strong crypto

- Crypto graph

- Top 20 cryptocurrency

- 1 btc in usd

- Crypto com earn

- Crypto credit lines

- Ether 1 crypto

- Best bitcoin wallet

- Crypto announcements

- How much is bitcoin

- Btc payment method

- How much is bitcoin today

- When to buy bitcoin

- How to add bank account to cryptocom

- Bitcoin store near me

- Create cryptocurrency

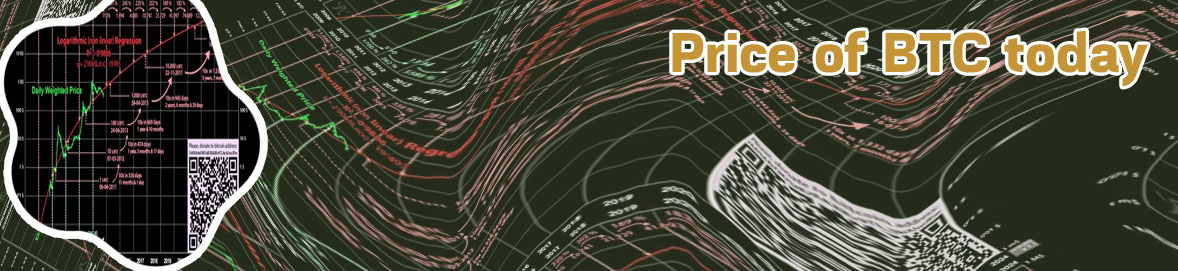

- Bitcoin historical price

Bitcoin price usd

Bitcoin price in USD has been a topic of interest for many investors and traders. Understanding the factors that influence the price of Bitcoin can help make informed decisions when it comes to buying or selling this popular cryptocurrency. To gain insights into the current state of Bitcoin price in USD, here are three articles that provide valuable information on this topic:

Analyzing the Factors Influencing Bitcoin Price in USD

Bitcoin has become a popular topic of discussion in recent years, with many investors trying to understand the factors that influence its price in USD. As a decentralized digital currency, Bitcoin is not tied to any government or financial institution, making it a unique asset in the world of finance.

One of the key factors that influence the price of Bitcoin is market demand. When there is high demand for Bitcoin, the price tends to rise, and vice versa. This demand can be influenced by a variety of factors, including economic uncertainty, regulatory developments, and investor sentiment.

Another factor that can influence the price of Bitcoin is the supply of new coins entering the market. Bitcoin is created through a process called mining, where miners use powerful computers to solve complex mathematical problems. As more coins are mined, the supply of Bitcoin increases, which can put downward pressure on the price.

In addition to market demand and supply, other factors that can influence the price of Bitcoin include technological developments, geopolitical events, and macroeconomic trends. By analyzing these factors, investors can gain a better understanding of the forces at play in the Bitcoin market and make more informed investment decisions.

The Relationship Between Bitcoin Price in USD and Market Trends

Bitcoin, the most popular cryptocurrency in the world, has been making headlines once again as its price in USD continues to fluctuate alongside market trends. The volatile nature of Bitcoin has always been a topic of interest for investors and financial experts alike, with many trying to predict its next move.

In recent months, Bitcoin's price has been closely linked to global market trends, especially in the wake of the COVID-19 pandemic. As the world economy continues to recover from the effects of the pandemic, the price of Bitcoin has been affected by a variety of factors such as inflation fears, government regulations, and investor sentiment.

For example, when the stock market experiences a downturn, we often see a corresponding drop in the price of Bitcoin. This correlation highlights the interconnectedness of different financial markets and the impact they can have on each other.

Understanding the relationship between Bitcoin price in USD and market trends is crucial for anyone looking to invest in cryptocurrency or those simply interested in keeping up with the latest financial news. By staying informed about these trends, investors can make more informed decisions about when to buy or sell Bitcoin, ultimately helping them maximize their returns in this fast-paced market.

In conclusion, analyzing the relationship between Bitcoin price in USD and market trends is essential for anyone involved in the cryptocurrency space. By

Predicting Future Bitcoin Price in USD: A Data-Driven Approach

In the realm of cryptocurrency, the ability to predict future Bitcoin prices is a coveted skill that many strive to master. This article presents a data-driven approach to forecasting the USD value of Bitcoin, utilizing historical data and advanced analytical techniques.

The authors delve into the intricacies of Bitcoin price prediction, highlighting the importance of understanding market trends, volatility, and external factors that can impact the value of the digital currency. By analyzing a wealth of data points and employing sophisticated algorithms, they demonstrate how predictive models can be used to forecast future price movements with a high degree of accuracy.

One key takeaway from the article is the significance of incorporating real-time data and market sentiment analysis into Bitcoin price forecasting models. By leveraging up-to-date information and sentiment analysis tools, analysts can gain valuable insights into market dynamics and make more informed predictions about future price trends.

In conclusion, this article serves as a valuable resource for anyone interested in understanding the intricacies of predicting Bitcoin prices using a data-driven approach. By focusing on key factors such as market trends, volatility, and sentiment analysis, analysts can enhance their ability to forecast future price movements with precision.

Recommendation:

- Incorporate sentiment analysis tools for real-time market insights.

- Consider the impact of external factors on Bitcoin price fluctuations.

- Explore different