- Home

- Cryptocurrency bitcoin price

- Eth max price

- When could you first buy bitcoin

- Cryptocurrency company

- Buy ethereum with credit card

- Centralized crypto exchanges trading volume year

- Cryptocurrency exchanges

- Bitcoin's value today

- Multichain ethereum binance smart chain avalanche

- Send bitcoin

- Crypto to usd

- Btcto usd

- Buy crypto with credit card

- Sos crypto

- Bitcoin price usd prediction

- 3 reasons to buy dogecoin

- Where to buy ethereum max

- Etc crypto

- Crypto dogecoin

- What the hell is bitcoin

- Current eth gas price

- Cryptocom trading fees

- Bitcoin trend

- Buy elon crypto

- 1bitcoin to dollar

- Dogecoin volume

- Where to buy crypto

- Apps cryptocurrency

- Elongate crypto

- Dogecoin converter

- Dent crypto

- How many btc are there

- Where to buy bitcoin

- Ethusd converter

- Price of bitcoins in usd

- Best broker to buy dogecoin

- Safemoon crypto price

- Bitcoin cryptocurrency

- Cryptocurrency to buy

- Cryptocoin com coin

- Cryptos

- How much is 1 bitcoin worth in cash

- Inu passes no cryptocurrency

- To invest all profits in crypto

- Where to buy shiba inu crypto

- Bitcoin euro

- Strong crypto

- Crypto graph

- Top 20 cryptocurrency

- 1 btc in usd

- Crypto com earn

- Crypto credit lines

- Ether 1 crypto

- Best bitcoin wallet

- Crypto announcements

- How much is bitcoin

- Btc payment method

- How much is bitcoin today

- When to buy bitcoin

- How to add bank account to cryptocom

- Bitcoin store near me

- Create cryptocurrency

- Bitcoin historical price

Bitcoin era

As the Bitcoin era continues to evolve, it's crucial to stay informed on the latest developments and trends in the world of cryptocurrency. Whether you're a beginner looking to learn the basics or an experienced investor seeking advanced strategies, these 4 articles will provide valuable insights and information to help you navigate the complex landscape of Bitcoin and other digital currencies.

The Rise of Bitcoin: A Beginner's Guide to Cryptocurrency

"The Rise of Bitcoin: A Beginner's Guide to Cryptocurrency" is an informative book that delves into the world of digital currency, specifically focusing on Bitcoin. Authored by a team of experts in the field, this book provides a comprehensive overview of the history, technology, and potential impact of cryptocurrencies on the global economy.

One of the key highlights of this book is its detailed explanation of how Bitcoin works. The authors break down complex concepts such as blockchain technology, mining, and wallets in a way that is easy for beginners to understand. Additionally, the book explores the potential applications of Bitcoin beyond just being a digital currency, such as smart contracts and decentralized finance.

Furthermore, "The Rise of Bitcoin" provides valuable insights into the market trends and factors that influence the price of Bitcoin. By analyzing historical data and market indicators, readers can gain a better understanding of how to navigate the volatile world of cryptocurrency trading.

Overall, this book is a valuable resource for anyone looking to learn more about Bitcoin and cryptocurrency. Whether you are a novice investor or a seasoned trader, "The Rise of Bitcoin" offers valuable information that can help you make informed decisions in the world of digital finance.

Navigating the Volatility of the Bitcoin Market: Tips for Investors

The Bitcoin market has become synonymous with volatility, making it a challenging environment for investors to navigate. With prices swinging wildly on a daily basis, it can be difficult to make informed decisions about buying or selling. However, there are several tips that investors can use to help them navigate this uncertain landscape.

One key strategy for managing the volatility of the Bitcoin market is to diversify your investment portfolio. By spreading your investments across different assets, you can reduce the impact of any one asset's price fluctuations on your overall portfolio. This can help to mitigate risk and protect your investments from extreme market movements.

Another important tip for investors is to stay informed about market trends and news. The cryptocurrency market is highly influenced by external factors such as regulatory developments, technological advancements, and macroeconomic trends. By staying up to date on these factors, investors can make more informed decisions about when to buy or sell their Bitcoin holdings.

Additionally, investors should consider setting stop-loss orders to automatically sell their Bitcoin if prices fall below a certain threshold. This can help to limit potential losses and protect your investments from significant downturns in the market.

In conclusion, navigating the volatility of the Bitcoin market can be a daunting task. However, by diversifying your portfolio, staying informed about market trends, and setting stop-loss orders

Understanding Blockchain Technology: The Backbone of the Bitcoin Revolution

Blockchain technology has become a buzzword in the world of finance and technology, especially with the rise of cryptocurrencies like Bitcoin. This innovative technology is essentially a decentralized, distributed ledger that records transactions across multiple computers in a secure and transparent manner. It has the potential to revolutionize various industries by increasing efficiency, reducing costs, and enhancing security.

One of the key features of blockchain technology is its immutability. Once a transaction is recorded on the blockchain, it cannot be altered or deleted, making it a reliable and tamper-proof system. This feature is crucial for industries like finance, healthcare, and supply chain management, where data integrity is of utmost importance.

Blockchain technology also offers transparency, as all transactions are recorded on a public ledger that can be viewed by anyone. This ensures accountability and trust among users, as they can verify the authenticity of transactions without relying on intermediaries.

Moreover, blockchain technology eliminates the need for intermediaries such as banks or payment processors, reducing transaction costs and increasing the speed of transactions. This has significant implications for financial services, where blockchain can facilitate faster and cheaper cross-border payments.

In conclusion, understanding blockchain technology is essential for anyone looking to grasp the potential of this groundbreaking technology. Its features of immutability, transparency, and efficiency have the power to

Regulatory Challenges in the Bitcoin Era: What Investors Need to Know

As the popularity of cryptocurrencies like Bitcoin continues to rise, so do the regulatory challenges that investors face in this new era. Understanding the regulatory landscape is crucial for anyone looking to invest in Bitcoin, as the legal framework surrounding these digital assets is still evolving.

One key regulatory challenge that investors need to be aware of is the lack of uniformity in regulations across different countries. While some countries have embraced cryptocurrencies and have put in place clear regulatory frameworks, others are still grappling with how to regulate this new asset class. This lack of uniformity can create uncertainty for investors, as they may not know which regulations apply to their investments.

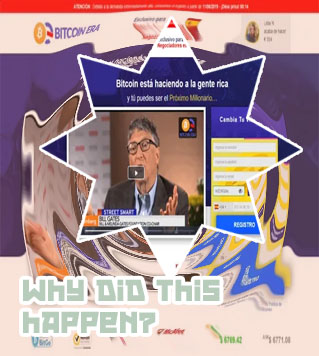

Another regulatory challenge for Bitcoin investors is the risk of fraud and scams. The anonymous and decentralized nature of cryptocurrencies makes them an attractive target for fraudsters, who may take advantage of unsuspecting investors. This is why it is important for investors to do their due diligence and only invest in reputable and regulated exchanges.

Overall, navigating the regulatory challenges in the Bitcoin era can be complex, but with the right knowledge and guidance, investors can protect themselves and make informed investment decisions. Understanding the regulatory landscape and staying up to date on any changes is essential for anyone looking to invest in Bitcoin.